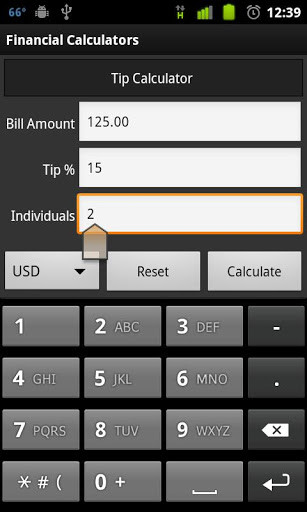

This setting impacts interest calculations when you set compounding frequency to a day based frequency (daily, exact/simple or continuous) or when there are odd days caused by an initial irregular length period. These options are available by clicking on "Settings." Related: Three Easy Ways to Save on Your Next Loan For a complete explanation of these options, see Nine Loan Amortization Methods. Amortization Method - leave this setting set to "normal" unless you have a specific reason for setting it otherwise.More about loan schedules with points, fees, and APR support. Points - one point is one percent of the loan amount.Setting this option to "Exact/Simple" results in simple, exact day interest. Doing so results in simple, periodic interest. Compounding Period or Frequency - usually, the compounding frequency should be set to the same setting as the payment frequency.The schedule calculates the payment dates from the first payment due date (not the loan date). Payment Period or Frequency - how often do you want to schedule payments? The calculator supports 11 options, including biweekly, monthly, and semiannual (useful for bond coupon interest schedules).Four loan options you most likely don't need to touch. More details about the settings available for odd day and irregular period interest.

#Financial calculators online full

However, if you want to match other calculators, then set the "Loan Date" and "First Payment Due" so that the time between them equals one full period as set by "Payment Frequency."Įxample: If April 10th is the "Loan Date" and the "Payment Frequency" is "Monthly," then set the "First Payment Due" to May 10th, that is if you want an estimated interest calculation. Important - Selecting dates will result in interest charges as well as payment calculations that do not match other calculators. First Payment Due - for leases, it may be the same as the loan date otherwise, loan payments will usually start sometime after the borrower has had access to the loan proceeds.If the loan is for a vehicle or home, it is also known as the loan's closing date or start date. Loan Date - the date the money is available.If you want an accurate, to the penny amortization schedule, you should spend a minute or two understanding these options. If you want an estimated schedule, you may skip over this section. set the annual interest rate to zero, andĪbout Dates - they may be (or may not be) important (to you):.What interest rate allows me to pay $500 a month?.How do I calculate how long it will take to pay off a loan?.How do I calculate how much I can borrow?.For "normal amortization," this includes principal and interest. Payment Amount - the amount that is due on each payment due date.

This the quoted interest rate for the loan.

Number of Payments (term) - the length of the loan.Loan Amount - the amount borrowed, i.e., the principal amount.

0 kommentar(er)

0 kommentar(er)